florida estate tax limit

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. There is no inheritance tax or estate tax in Florida.

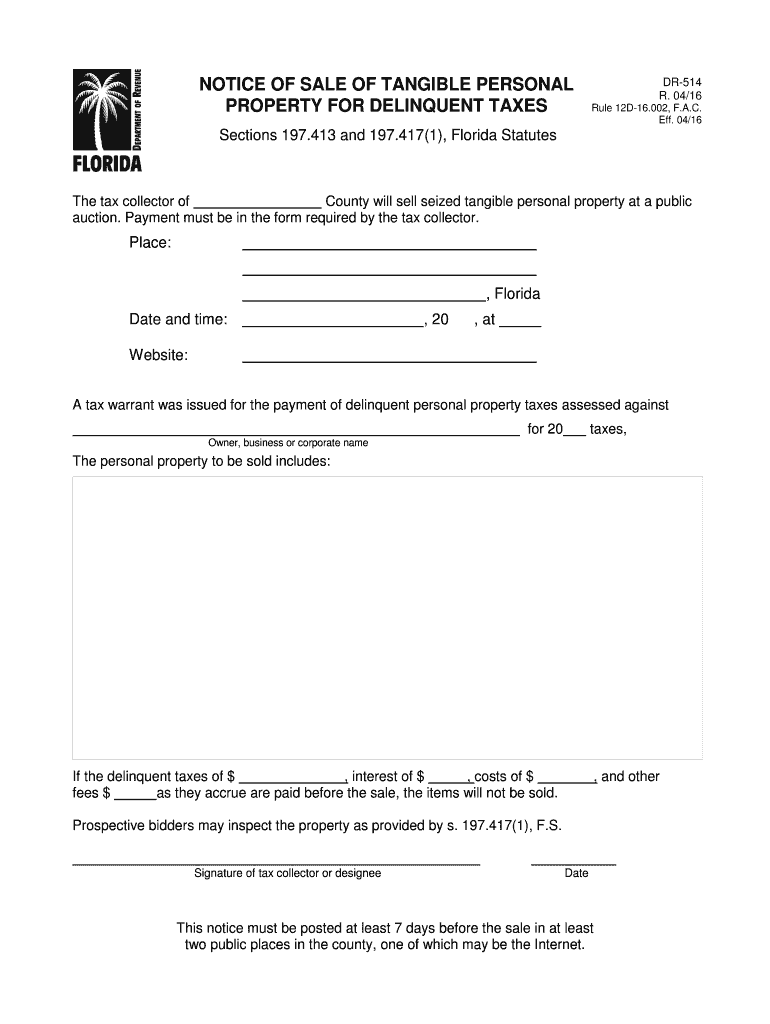

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

Federal Estate Tax.

. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida. The pro rata portion of the estate tax due Florida is determined by the following formula.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of. The estate tax is a tax on an individuals right to transfer property upon your death.

The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead. You would receive 950000. If the estate value is.

And to find the amount due the fair market values of all the decedents assets as of death are. Florida also has an exception for personal. Gross Value of FL Property 1 X Federal Credit for State Death Taxes from Form 7062 Florida.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The appraiser multiplies the city or towns millage rate by the. But if you transfer an estate valued at something higher than that upon death the federal government can tax a portion of the estate you leave behind before its transferred to.

The value of the estate must be equal to or less than 75000 or. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Tax amount varies by county.

Florida estate tax limit. Florida Estate Tax Limit. You would pay 95000 10 in inheritance taxes.

Heres an overview of each one from the. The decedent must have been dead for more than 2 years. For estates of decedents who died on or after January 1 2005 and before January 1 2013 no Florida estate tax is due.

The estate would pay 50000 5 in estate taxes. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 And to find. Ten mills is equal to one percent.

What this means is that. Pursuant to the Internal. The Florida estate tax is tied directly to the state death tax.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This means that whether you are required to file an estate tax return in Florida depends on whether you are required to file one with the Internal Revenue Service. Its OK for the tax roll market value of a home to be up to 15 below the actual value but any more than that will cause the sellers portability to be lower than it should be.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. In Florida there are three ways to settle an estate.

Some States recognize both the Small Estate affidavit and Summary Administration basing the requirement of which one to use on the value of the estate. If the decedent is a Florida resident the DOR may release the lien without requiring payment of the Florida estate tax if less than 50 percent of the aggregate Florida real estate is. Mill rates are equal to a percentage of the per dollar of value of a property.

097 of home value.

Eight Things You Need To Know About The Death Tax Before You Die

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Property Tax H R Block

How Your Estate Is Taxed Or Not

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Attorney For Federal Estate Taxes Karp Law Firm

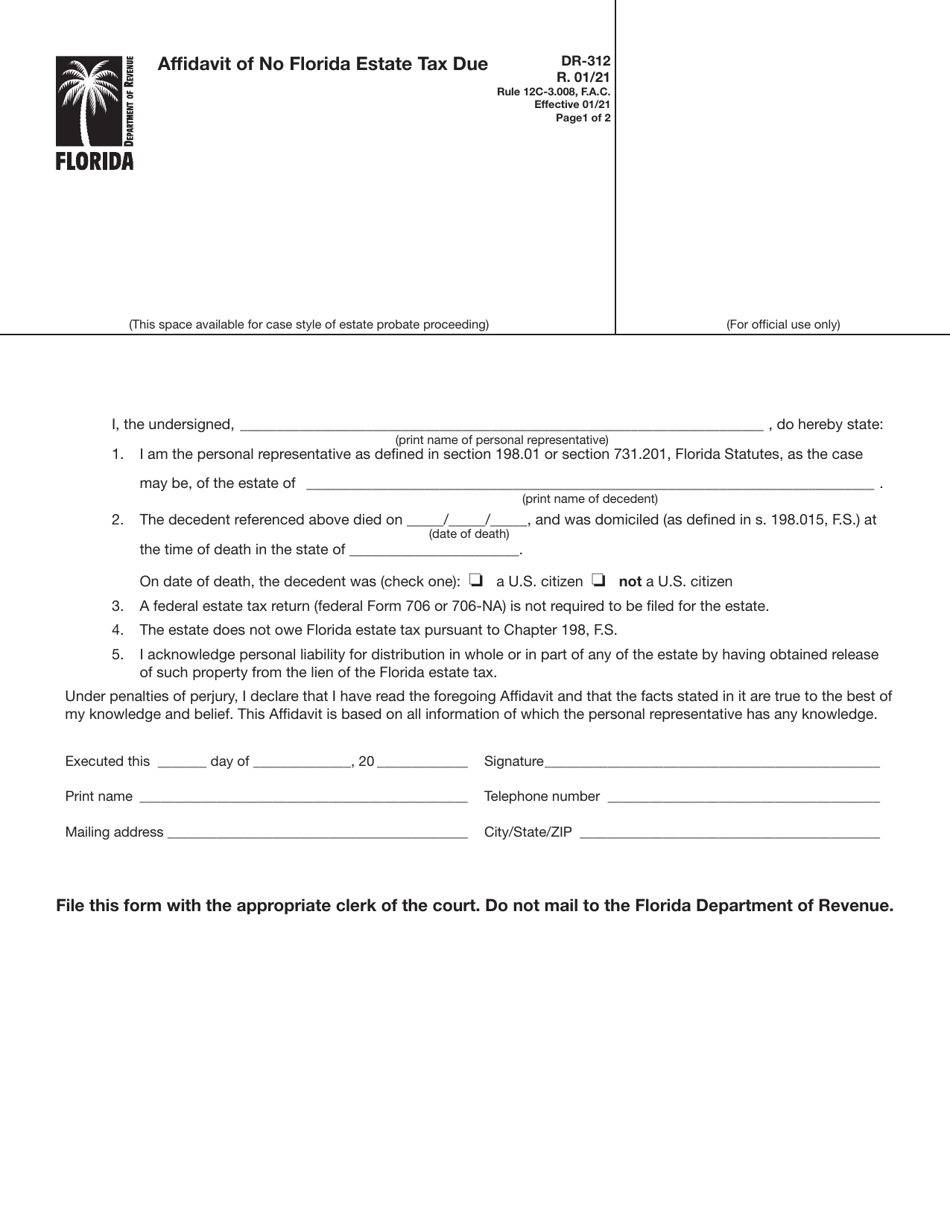

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Florida Inheritance Tax Beginner S Guide Alper Law

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Gift Tax All You Need To Know Smartasset

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Recent Changes To Estate Tax Law What S New For 2019

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm